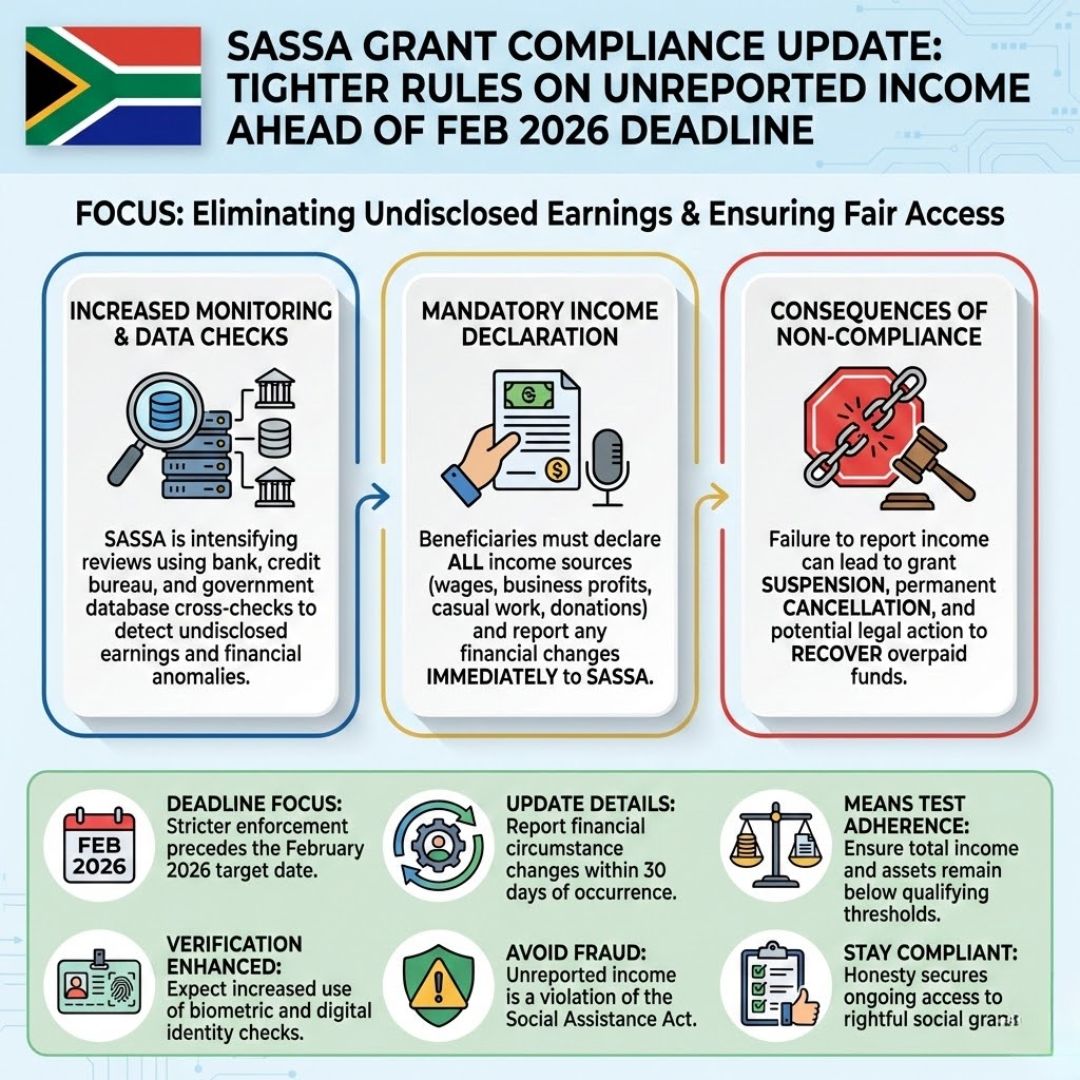

The South African Social Security Agency (SASSA) is stepping up compliance checks ahead of the February 2026 deadline, making the country’s social grant system stricter. Many people have called the move a “crackdown on unreported income.” Its goal is to protect vulnerable beneficiaries and make sure that public funds are distributed fairly. Millions of people depend on grants like the Old Age Pension, Disability Grant, and SRD support. The new rules make it clear that transparency is no longer a choice. This is what people who get benefits in South Africa need to know.

SASSA Tightens Checks on Unreported Income Before February 2026

SASSA has confirmed that stricter verification systems will be put in place as part of a larger “income disclosure policy.” The agency is finding people who didn’t report extra income by doing better bank account reviews and checking them against other government databases. Officials say the goal is not to punish anyone, but to restore the integrity of the grant system. However, people who break the rules could have their payments stopped or even be told to pay back what they owe. Beneficiaries should strongly encourage to update their records and make sure that all of their sources of income are properly reported as the February 2026 compliance deadline approaches.How the February 2026 SASSA Compliance Deadline Will Affect Beneficiaries The February 2026 deadline is more than just an update for the sake of business; it marks a move toward real-time verification and stricter oversight. SASSA is using digital monitoring systems to find differences between what people say they make and what they actually do with their money. This has a big effect on people who get help from more than one source or work part-time. Your means test assessment must show even small amounts of money you make. People who get notification letters or SMS alerts and don’t pay attention to them may have their grants temporarily frozen until their information is verified. Taking action early and responding quickly can keep you from getting stressed out and losing your monthly payments.

Why SASSA’s Grant Compliance Drive is Important for South Africa

This compliance campaign is part of a bigger effort to make sure that South Africa’s stretched social welfare budget is used fairly. Authorities say that every rand must go to the right people because demand is rising and the economy is under pressure. SASSA wants to reduce abuse and increase public trust in the grant system by making fraud detection measures stronger. Some beneficiaries are worried about stricter controls, but officials say that honest recipients have nothing to worry about. The main goals are still to be open, responsible, and make sure that grants last for a long time for millions of South Africans who need them.

R3,070 SASSA Grant February 2026 Breaks Down Eligibility and Payment Schedule - What to Verify

R3,070 SASSA Grant February 2026 Breaks Down Eligibility and Payment Schedule - What to Verify What This Means Going Forward

The February 2026 deadline for compliance is a turning point in how social grants are handled in the future. Beneficiaries should use this time to go over their papers, double-check their reported income, and respond quickly to official notices. Making sure that income is reported correctly will lower the chance of interruptions and keep finances stable. As SASSA updates its oversight with automated data checks, being open and honest becomes even more important. In the end, the goal of these changes is to protect the system for future generations and make sure that support goes to people who really qualify under South Africa’s changing welfare system.

What Beneficiaries Must Do Possible Consequence if Ignored Make sure the account information is correct Send in new copies of your financial documents Reply to texts or letters right away If asked, give proof of your claim.

Common Questions (FAQs)

1. What does the SASSA deadline in February 2026 mean?

It makes beneficiaries responsible for making sure that all of their income is reported correctly before stricter compliance checks start.

2. Will a small side job affect my grant?

Yes, you must report any extra income because it could affect the results of your means test.

3. What do I do if I get a notice of compliance?

To avoid having your payment stopped, you need to respond right away and send in the requested documents.