As governments work to end what many call “silent rule changes,” Australia is entering a time of quick regulatory change. Before February 2026, there will be a lot of changes to welfare, taxes, transportation, and compliance systems all over the country. These updates are not small changes for families, businesses, and retirees; they change the rules for who can get benefits, how to report income, and how to plan for retirement. Authorities are now focusing on clearer communication and structured transitions to make sure Australians are ready, instead of making quiet changes that are hidden in official notices.Ending Silent Policy Changes Across AustraliaFor years, Australians have complained about “unannounced compliance shifts” that changed benefits or duties without many people knowing about them. The new reform package aims to get rid of these surprises by making public briefings and clearer transition windows mandatory. Before making changes to eligibility or penalties, agencies must now publish “advance policy notices.” This method is meant to keep seniors, small businesses, and low-income families from sudden changes. Policymakers want to restore trust and cut down on confusion about changes that affect everything from welfare payments to licensing rules by making things more clear and setting “structured rollout timelines.”

Changes to National Rules Before February 2026

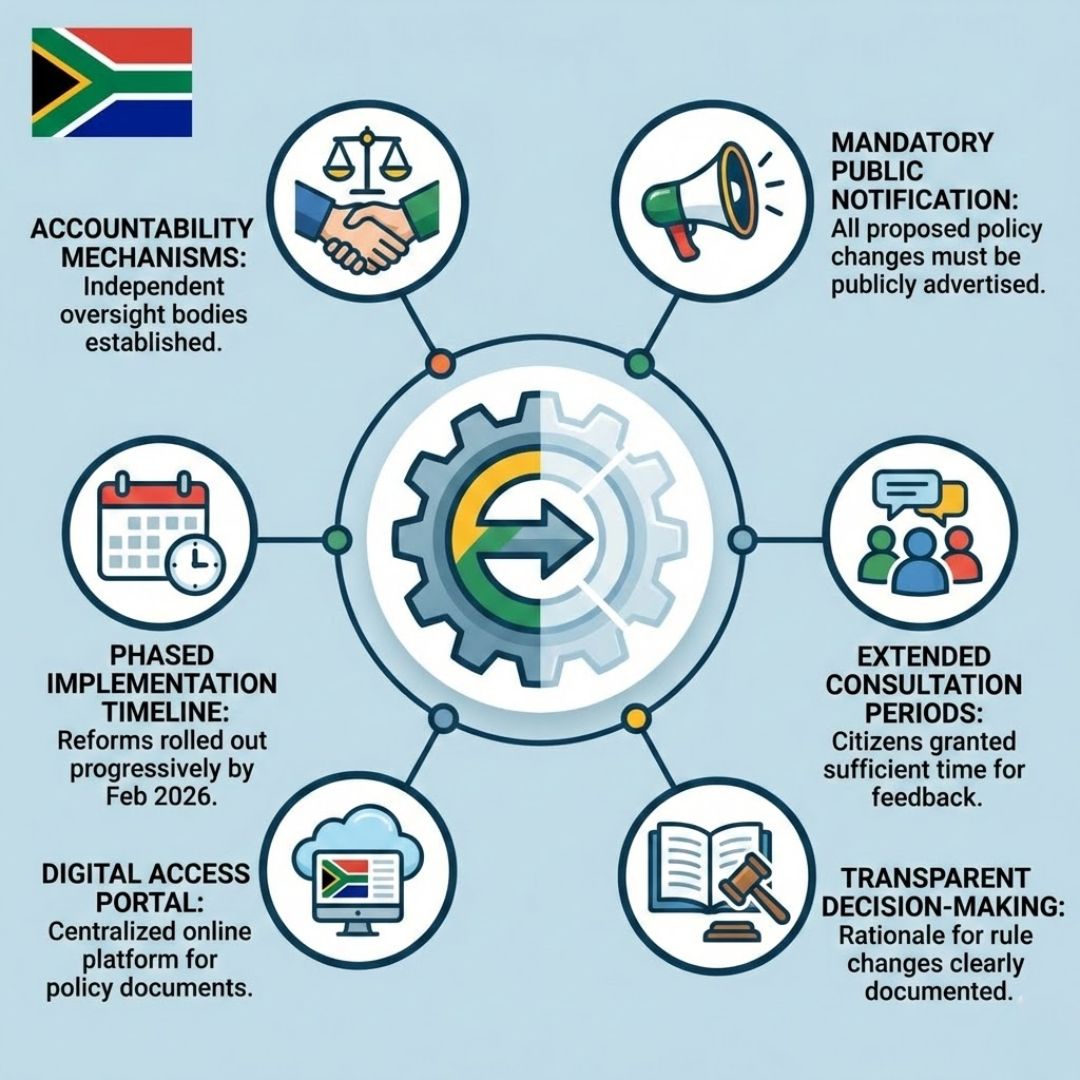

Under a “federal-state alignment plan,” several areas will get coordinated updates before February 2026. This includes better benefit thresholds, new compliance audits, and better digital reporting standards. Authorities are also putting money into “centralised information portals” so that people can see how reforms are going in real time. One important change is the addition of “transition grace periods,” which give Australians time to get used to the new rules before they are punished. Instead of making changes that are different in different parts of the country, the government is making changes that are the same across the country. This will help make the rules more consistent and less likely to conflict between states.

How the New Nationwide Policies Affect Households

For regular Australians, these changes could affect benefits, tax reporting, and even the need for licenses. Families who depend on welfare programs might have clearer rules about who can get help, thanks to updated income assessments. Small business owners may need to look over the new rules for documentation that come with stronger compliance systems. At the same time, retirees should keep an eye on “pension verification updates” that are linked to digital identity checks. Change can be hard to deal with, but the bigger goal is to make “transparent governance standards” that stop confusion and unexpected financial stress. The focus is on being clear, talking to each other, and giving people enough time to adjust.

What These Changes to Policy Mean for Australia

The move away from silent amendments is a sign of a bigger change in the way rules are made and enforced. Australia is moving toward predictable reform cycles that are backed by clearer ways for the public to get involved and hold people accountable. The government wants to boost people’s and businesses’ confidence in planning by replacing random updates with coordinated announcements. Even though making changes may still take work, the promise of “clear communication channels” and phased rollouts makes things less uncertain. As February 2026 gets closer, it will be important to stay up to date on official news in order to handle these big changes to national policy well.

| Policy Area | Type of Reform | Implementation Window | Who Is Affected |

|---|---|---|---|

| Welfare Benefits | Eligibility & reporting updates | Jan–Feb 2026 | Pensioners, carers, low-income families |

| Tax Compliance | Digital reporting standards | Before Feb 2026 | Small businesses, contractors |

| Licensing Rules | Verification reforms | Early 2026 | Drivers, regulated professionals |

| Public Communications | Advance notice requirements | Immediate rollout | All citizens |

Common Questions (FAQs)

1. What are silent rule changes?

They are policy updates introduced with limited public communication, often surprising affected groups.

Goodbye to Unreported Income: SASSA Tightens Grant Compliance Ahead of February 2026 Deadline

Goodbye to Unreported Income: SASSA Tightens Grant Compliance Ahead of February 2026 Deadline 2. When will the nationwide reforms take effect?

Most reforms are scheduled to roll out gradually before February 2026.

3. Who will be most impacted by these changes?

Pensioners, small businesses, and welfare recipients are among the key groups affected.

4. How can Australians stay informed?

By monitoring official government portals and agency announcements for verified updates.