The government of South Africa is getting ready to get rid of some old pension plans as part of the February 2026 regulatory reforms. This means that the country is moving into a new phase of retirement policy. For a lot of retirees and people who are about to retire, this means a big change in how benefits that have been around for a long time will be looked at and changed. The goal is to make the system more modern and fairer, but the change has made people both curious and worried. Anyone in South Africa who depends on retirement income needs to know how legacy pension plans will be looked at.

February 2026 Rules Will Look at Old Pension Plans

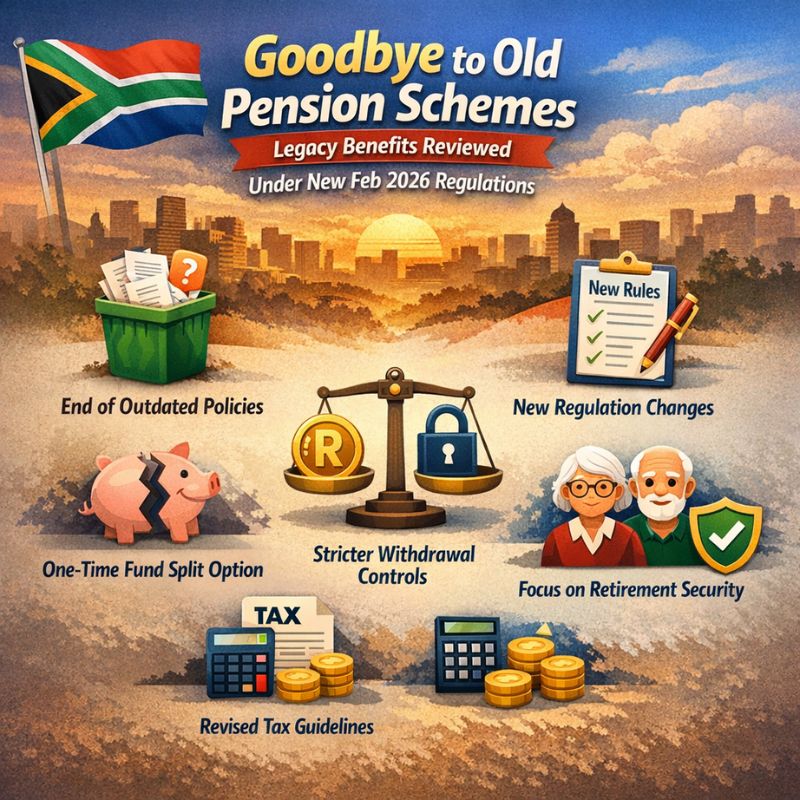

Changes in February 2026 will be a turning point for traditional retirement plans that have been around for a long time. Officials plan to do a full benefit review to see if the program is still viable and meets the new financial standards. Many plans that were protected by “legacy pension rules” will now be looked at again to make sure they follow “updated retirement policies.” This process includes checking contribution histories, recalculating projected payouts, and making sure everything is clear. For retirees, the main goal will be to keep their income stable while getting used to the new compliance standards. Officials say that fairness and long-term viability are the most important parts of the transition strategy, even though changes may be different in each case.

Changes to Legacy Benefits in South Africa’s Pension Reform Plan

As South Africa moves forward with reform, legacy benefits will slowly be replaced by a new system that is meant to lower inequality across all types of retirement. Workers who were previously enrolled in defined benefit plans may have their benefits recalculated based on contribution history checks and actuarial evaluations. The change also adds “income protection measures” to keep weak retirees safe during the transition. The government has promised a “phased implementation timeline” to avoid sudden changes in finances, which is very important. This careful rollout aims to strike a balance between being fiscally responsible and protecting social welfare. It makes sure that pensioners don’t have to worry about their future payments.

Change in Pension Policy in February 2026 and What It Means for Retirees

The bigger change in policy shows that South Africa wants to make its retirement system more open and long-lasting. With the new framework, there will be more regulatory oversight to keep a closer eye on how funds are managed. To help reach “financial sustainability goals,” pension funds now have to follow stricter rules for reporting. Better ways to figure out benefits and clearer ways to talk to retirees could also help them. Some changes might affect how payouts are made, but the reforms are meant to make the system stronger against economic ups and downs and make sure it stays stable for future generations.

Looking at the direction of South Africa’s retirement reform

In general, the rules from February 2026 show a clear move away from old-fashioned pension systems and toward a streamlined national model. Policymakers say that changes need to be made to deal with funding gaps and demographic pressures. Authorities want to restore public trust and promote “retirement income security” by adding stricter supervision and recalibration systems. The focus on gradual change shows that people know that retirees need steady payments. If handled properly, the changes could make things run more smoothly while still protecting social welfare. This could change South Africa’s pension system for decades to come.

| Aspect | Before February 2026 | After February 2026 |

|---|---|---|

| Scheme Structure | Several old plans | Unified model for regulation |

Most Commonly Asked Questions (FAQs)

1. What will be different about the pension rules starting in February 2026?

The government will look at older pension plans in South Africa and make sure they meet the new national retirement standards.

SASSA February 2026 Payment Update: R560 and R1,250 grants paid on 27 February with tracking tips

SASSA February 2026 Payment Update: R560 and R1,250 grants paid on 27 February with tracking tips 2. Will retirees lose the benefits they already have?

No, benefits will be looked at again, but income protection measures are meant to stop sudden losses.

3. Who will be most affected by the change?

The new rules will have the most direct effect on people who are already in long-term legacy pension plans.

4. When will the new rules for pensions take full effect?

The changes will start in February 2026 and happen slowly over time.