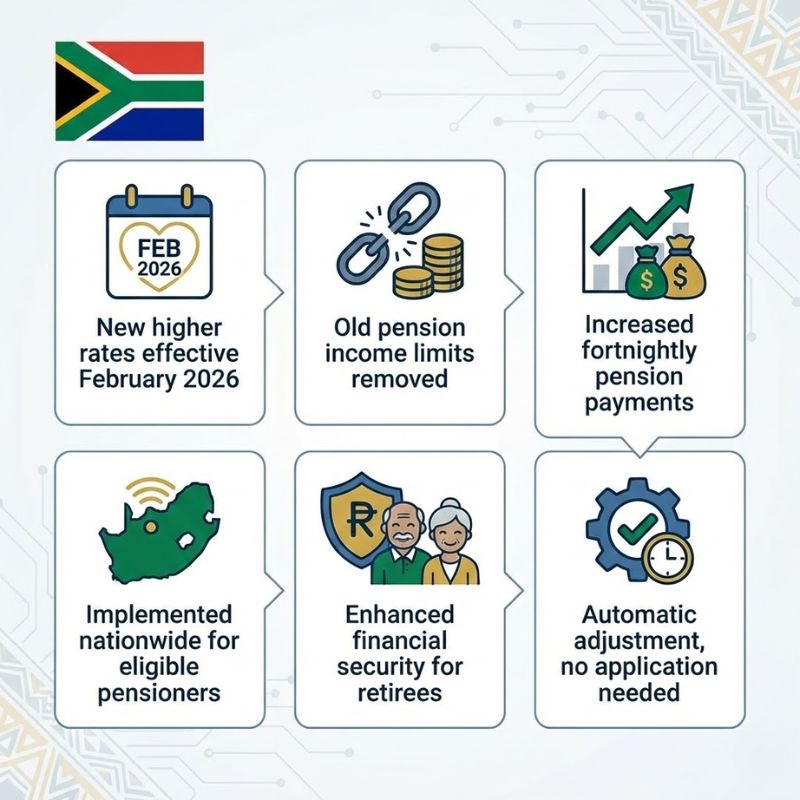

In February 2026, people all over South Africa will be able to get bigger grants. This will have a big impact on how much money pensioners have. The announcement is basically a way of saying “goodbye” to the old pension limits that many seniors thought were unfair because costs were going up. The new structure is supposed to help more as food prices, electricity rates, and healthcare costs keep going up all over South Africa. These changes could bring back stability and a more realistic safety net for millions of people who depend on the SASSA Older Person’s Grant in the coming months.

There are no more old payment limits, and SASSA pension rates are now higher.

The new Older Person’s Grant program will give the government more money each month starting in February 2026. The change is more than just the usual small changes to inflation; it also raises the income limits for grants to make them easier to get. The means test limits have gone up, so seniors who were close to the cut-off before may now be able to get help. At the same time, the government has looked at asset value caps to make sure they are more in line with how much property and savings are worth right now. This is a practical reset for a lot of older South Africans that will make pension support more in line with the real problems that families are having all over the country.

All over South Africa, pensions will go up in February 2026.

In February 2026, the rollout will happen all over the country, making sure that all eligible beneficiaries get updates on their payments. SASSA has said that changes will happen automatically, so people who get benefits don’t have to fill out new applications. The reform is a direct response to rising food prices and higher municipal service fees that are hurting retirees on fixed incomes. The rise gives people who are already getting payments more money each month, which can help them feel less stressed about their budgets. It’s a way to get things back in balance at a time when many seniors feel like they don’t have enough money.

Changes to the limits on pensions and the stability of long-term grants

The change shows that South Africa wants to protect retirement income for the long term, not just the short term. Policymakers have stressed the need for stable funding and clearer rules for compliance to stop sudden disqualifications. The new framework adds adjusted eligibility bands to make it less likely that small changes in income will cause someone to lose their grant. This could mean that under the new system, pensioners who want to save money and work part-time will have more flexible evaluations. Officials hope that over time, the new method will make the grant system more stable and make sure that the people who need help the most get it.

What the New Pension Limits Mean for Older South Africans

February 2026 is more than just a normal increase for older people in South Africa. It shows how our understanding of how much it costs to retire in the modern world is changing. Now that the rules for assessments are clearer and the thresholds are higher, beneficiaries can plan with more financial certainty. Things won’t get better right away, but getting rid of old caps shows that the social support system is more responsive. If everything goes according to plan, the new grant structure could help older people who are having trouble making ends meet feel more confident about their finances.

| Category | Before February 2026 | From February 2026 |

|---|---|---|

| Older Person’s Grant (60–74) | Previous monthly rate | Increased monthly amount |

| Older Person’s Grant (75+) | Existing enhanced rate | Higher enhanced rate |

| Income Threshold | Older means test limit | Expanded income allowance |

| Asset Limit | Previous asset cap | Raised asset ceiling |

| Application Requirement | No change required | Automatic adjustment |

Questions that are often asked (FAQs)

1. When do the new SASSA pension rates go into effect?

The higher rates for the Older Person’s Grant will be available all over the country starting in February 2026.

2. Do people who get benefits have to apply again for the rise?

No, SASSA will automatically change payments that are eligible without you having to apply again.

3. Will the limits on the means test change?

Yes, the new framework changes the limits on both income and assets.

4. Is this true in every province?

Yes, the new limits and higher pension rates affect everyone in South Africa.