The South African Social Security Agency (SASSA) has said that starting in 2026, new rules for banking and payments will change how millions of people get their monthly grants. The new rules will make payments safer while also working to cut down on fraud and get grant money to the right people without any delays.

The New Banking Rules from SASSA

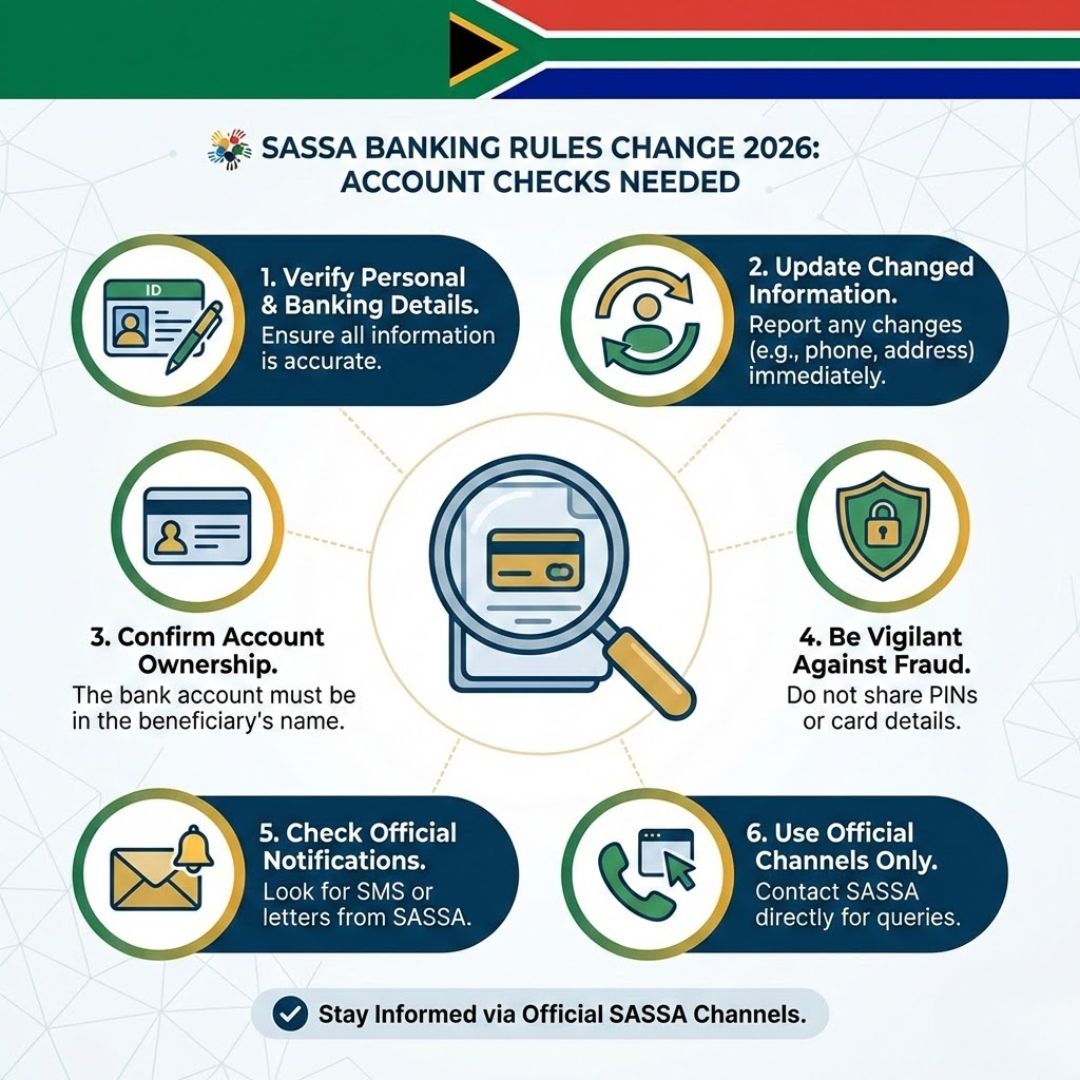

SASSA has had problems in the past few years because of wrong bank information, problems with verifying people’s identities, and false claims for payment. The new banking rules were made to find ways to make verification systems better and make it harder to distribute grant payments. The goal of the organization is to build a payment system that is both reliable and useful for its users.

New Rules for Checking Bank Accounts

Beneficiaries will have to register their bank account in their own name starting in 2026. This name must match the official identity information that SASSA has on file for them. The system will hold off on or deny payments to third-party accounts that don’t match the required accounts until verification is finished. Accounts that are inactive, closed, or have strange activity may be seen as unsafe, which could lead to temporary payment suspensions.

Effect on Monthly Grant Payments

These new rules will make the payment process more strict, but the amounts of the grants will stay the same. Because they didn’t update their banking information, beneficiaries will have to wait longer to get their money. SASSA has told people who get grants to check their payment information well in advance of the scheduled grant dates to avoid problems.

More Digital and Biometric Checks

For their 2026 system upgrades, the South African Social Security Agency (SASSA) will use digital and biometric verification methods. At certain pay points, beneficiaries must prove their identity by fingerprinting or using other secure methods. The system stops people who shouldn’t have access to grant money from getting it, while making sure that people who should get it do.What Beneficiaries Should Do Now: SASSA asks that beneficiaries update their banking information as soon as possible. People can make changes at approved SASSA locations and on official SASSA websites. SASSA requires beneficiaries to keep their contact information up to date because the agency uses these channels to send out notifications about verification and payment problems.

What Happens If You Don’t Update Your Banking Information

People who don’t follow new banking rules will have trouble getting their payments because they will be delayed until the verification process is complete. When beneficiaries’ records show wrong information, they need to go to an SASSA office. Taking action early will help people avoid stressful situations and money problems that will come up after the new rules go into effect.